Fairness benchmark indices Sensex and Nifty closed at recent lifetime highs on Friday following good points in banking, monetary and capital items shares amid a agency development within the world market.

A strengthening rupee and overseas capital inflows additional bolstered sentiment, merchants stated.

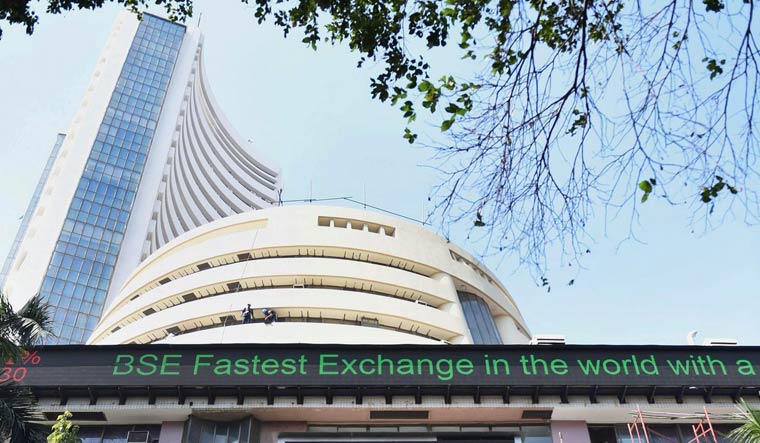

The 30-share BSE index zoomed 466.95 factors or 0.74 per cent to settle at a document closing excessive of 63,384.58. In the course of the day, it rallied 602.73 factors or 0.95 per cent to 63,520.36.

The index scaled its earlier lifetime excessive of 63,284.19 on December 1 final yr.

The NSE Nifty climbed 137.90 factors or 0.74 per cent to finish at its lifetime peak of 18,826. Its earlier document peak was 18,812.50.

On a weekly foundation, the BSE benchmark jumped 758.95 factors or 1.21 per cent, and the Nifty climbed 262.6 factors or 1.41 per cent.

“Markets surged strongly on Friday and inched nearer to the document excessive, monitoring agency world cues. After the agency begin, the Nifty index hovered in a slim band within the first half. Nevertheless, a pointy surge within the latter half helped the index to check 18,864.70 however it lastly settled at 18,826 ranges.

“Restoration in banking and financials mixed with shopping for in FMCG, pharma and vitality majors largely aided the rebound. In addition to, the continued shopping for in midcap and smallcap house additional added to the positivity,” Ajit Mishra, SVP – Technical Analysis, Religare Broking Ltd, stated.

The buoyancy within the world markets, particularly the US, helps the index to take care of a bullish tone amid combined home cues, Mishra added.

Shopping for in index main Reliance Industries and HDFC twins additionally helped the markets to rebound.

Bajaj Finserv was the most important gainer within the Sensex pack, rising 2.21 per cent, adopted by Titan, ITC, Kotak Mahindra Financial institution, HDFC Financial institution, HDFC, Bajaj Finance, IndusInd Financial institution, ICICI Financial institution, HUL, Reliance Industries and Mahindra & Mahindra.

Wipro, Tata Consultancy Companies, Energy Grid and Tech Mahindra had been the laggards.

Within the broader market, the BSE smallcap gauge climbed 0.76 per cent and the midcap index jumped 0.71 per cent.

Among the many indices, monetary providers climbed 1.21 per cent, bankex jumped 1.03 per cent, capital items (1.02 per cent), industrials (0.91 per cent), FMCG (0.80 per cent), client durables (0.78 per cent) and client discretionary (0.74 per cent).

IT, oil & fuel, realty and teck had been the laggards.

“World shares had been headed for the perfect week in additional than 9 weeks after a collection of Central Financial institution choices, lifted by bets that the Federal Reserve will quickly finish its tightening cycle and China will introduce recent stimulus measures,” Deepak Jasani, Head of Retail Analysis, HDFC Securities, stated.

In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong ended within the inexperienced.

Fairness markets in Europe had been buying and selling with good points. The US markets ended considerably greater on Thursday.

“The home market rebounded with robust shopping for in banking, pharma, and client shares, together with optimistic cues from world markets. The US market’s optimism was bolstered by better-than-expected retail gross sales, reflecting the robustness of the financial system.

“Moreover, jobless claims stay elevated, and a decline in import costs raised hopes for a protracted pause in rate of interest hikes by the Fed, contradicting their announcement of potential future price hikes made yesterday,” stated Vinod Nair, Head of Analysis at Geojit Monetary Companies.

The rupee rebounded by 34 paise to shut at a month excessive in opposition to the US greenback on Friday.

World oil benchmark Brent crude dipped 0.62 per cent to USD 75.20 a barrel.

Overseas Institutional Buyers (FIIs) purchased equities price Rs 3,085.51 crore on Thursday, in keeping with alternate information.

“We reiterate our optimistic view however recommend limiting positions citing intermediate choppiness. As a substitute of ready for a brand new excessive within the index, we really feel contributors ought to preserve their deal with figuring out stock-specific buying and selling alternatives,” Mishra stated.