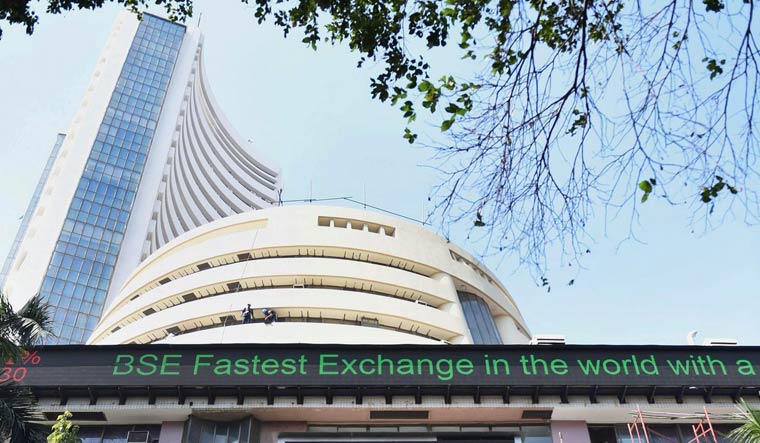

Fairness benchmark Sensex breached a brand new milestone of 70,000 factors earlier than closing 102 factors larger, whereas Nifty settled simply shy of the 21,000 mark on Monday, pushed by positive aspects in banking, IT and steel shares.

After a gap-up opening, the 30-share index rose to a document intra-day excessive of 70,057.83 factors. Later, it shed a number of the positive aspects to shut at 69,928.53 factors, displaying positive aspects of 102.93 factors or 0.15 per cent.

As many as 18 Sensex shares closed within the inexperienced, 11 declined, and one settled unchanged.

The broader Nifty additionally hit its document buying and selling excessive of 21,026.10 amid early positive aspects in world markets. The 50-share index gained 27.70 factors or 0.13 per cent to settle slightly below the 21,000 stage at 20,997.10, its all-time closing excessive.

Amongst Sensex shares, Ultratech Cement jumped probably the most by 3.04 per cent. Nestle rose by 1.3 per cent, Energy Grid by 1.05 per cent and Tata Motors by 0.85 per cent. Positive aspects in IndusInd Financial institution, HCL Tech, TCS, Tech Mahindra, NTPC, ITC, JSW Metal and Tata Metal helped the barometer scale a contemporary excessive.

Axis Financial institution fell probably the most by 1.26 per cent, M&M by 0.99 per cent and Hindustan Unilever by 0.67 per cent. Maruti, Bajaj Finserv, Bharti Airtel and HDFC Financial institution and Infosys additionally declined.

“The market crossed 70,000 ranges right this moment, whereas the broader market outperformed the primary indices. Nonetheless, revenue reserving was evident at larger ranges as merchants anticipated clues from tomorrow’s important information releases on inflation from the US and India, in addition to the IIP,” Vinod Nair, Head of Analysis at Geojit Monetary Companies, mentioned.

Buyers shall be intently watching the upcoming FOMC assembly tomorrow for clues about potential future price cuts whereas anticipating to maintain charges the identical this time, Nair added.

In the meantime, Asian markets had been combined. Hong Kong’s Cling Seng dropped 0.8 per cent and the Shanghai Composite added 0.7 per cent whereas Tokyo’s Nikkei 225 index gained 1.5 per cent.

In Europe, Germany’s DAX was unchanged, and the CAC 40 in Paris gained 0.2 per cent. In London, the FTSE 100 was down 0.4 per cent.

International Portfolio Buyers (FPIs) have turned bullish, investing Rs 26,505 crore into home equities within the first six buying and selling periods of December.