Markets watchdog Sebi, on Saturday, authorized a slew of proposals, together with offering flexibility to Not for Revenue Organisations (NPOs) in elevating funds by way of the social inventory alternate and in addition determined to introduce a regulatory framework for index suppliers.

Moreover, the regulator will put in place a brand new regulatory framework for facilitating Small and Medium Actual Property Funding Trusts (SM REITS) aside from amending norms to strengthen the safety of buyers who’ve pumped in cash into Different Funding Funds (AIFs).

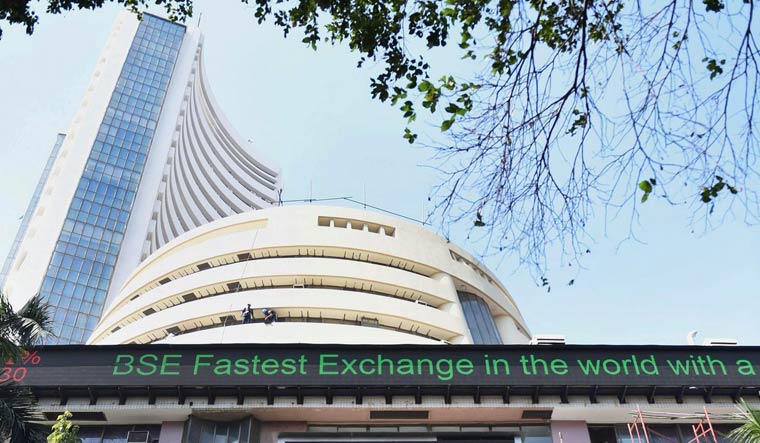

The choices have been taken by the board of the Securities and Trade Board of India (Sebi) throughout its assembly held in Mumbai.

On SM REITS, Sebi chairperson Madhabi Puri Buch stated the target is to assist develop the market considerably in order that extra retail buyers can have fractional possession in REIT items.

Sebi is open to creating extra such merchandise, Buch informed reporters after the board assembly.

In a launch, the regulator stated flexibility shall be supplied for fundraising by NPOs by way of the social inventory alternate.

On this regard, the minimal difficulty measurement in case of public issuance of Zero Coupon Zero Principal Devices (ZCZP) for NPOs on the social inventory alternate shall be diminished to Rs 50 lakh from Rs 1 crore.

Amongst different choices, a regulatory framework shall be launched for the index suppliers to foster transparency and accountability in governance and administration of economic benchmarks within the securities market.

With respect to AIFs, the regulator stated, “The mandate for appointment of custodian, presently relevant to schemes of Class III AIFs and to schemes of Class I and II AIFs with corpus greater than Rs 500 crore, shall be prolonged to all AIFs.”

Buch stated the choice to have rules for index suppliers was primarily pushed by growing inflows into passive funds, which have taken off in a giant method within the West.